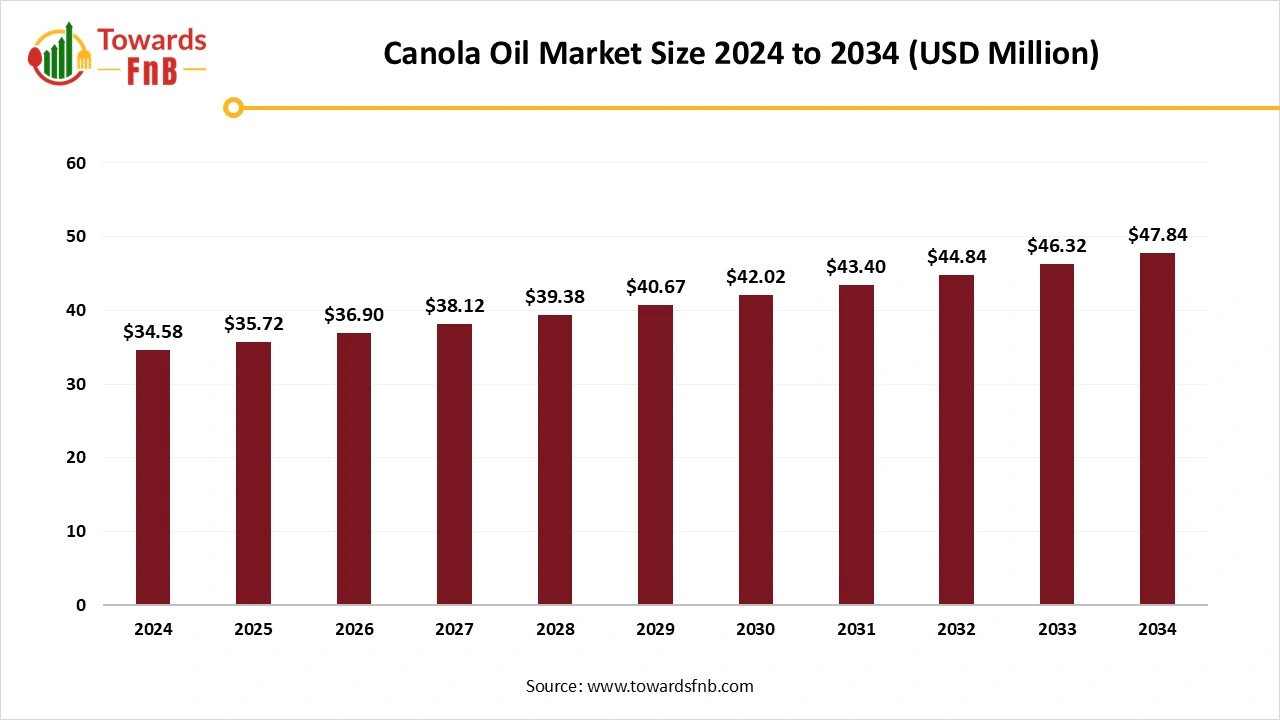

Ottawa, Nov. 21, 2025 (GLOBE NEWSWIRE) -- The global canola oil market size stood at USD 34.58 million in 2024 and is predicted to increase from USD 35.72 million in 2025 to reach around USD 47.84 million by 2034, according to a report published by Towards FnB, a sister firm of Precedence Research. This trajectory aligns with the estimated CAGR of 3.3% from 2025 to 2034, driven by sustained consumer preference for healthier and more versatile cooking oils.

The growth is due to excessive usage by users as they find unprocessed and natural products, which drives the urge for virgin canola oil because of its health advantages. Its high smoke point and neutral flavour are perfect for different cooking procedures, such as baking and frying.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5539

Canola Oil Market Key Highlights:

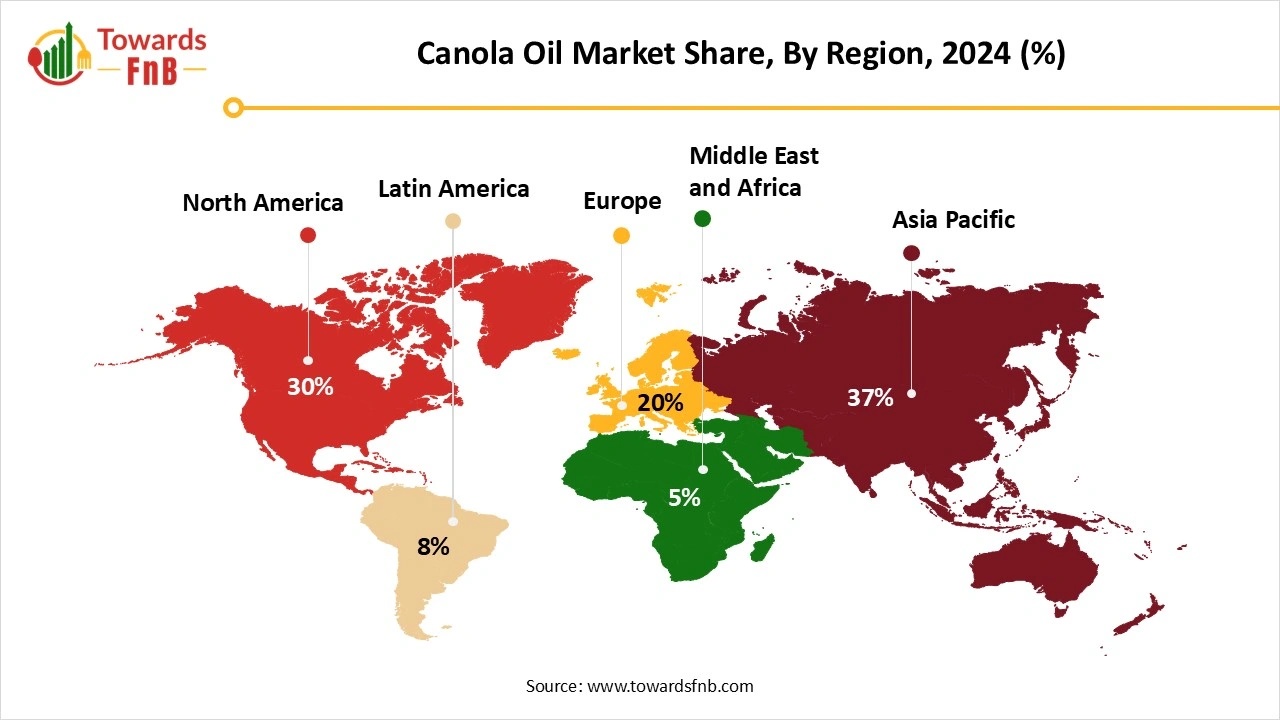

- By region, Asia Pacific dominated the market with the largest share of 37% in 2024. The growing demand for canola oil is driven by a shift in consumer preferences towards healthier cooking oils.

- By region, North America is expected to experience significant growth during the forecast period. This region’s expansion is attracting greater attention to canola cultivation among farmers.

- By product, processed canola oil held the majority market share of 72% in 2024. After harvesting, canola oil undergoes various processing stages to eliminate impurities and improve quality.

- By product, the virgin canola oil segment is projected to grow at the fastest rate during the forecast period. Increasing consumer awareness of health and wellness is driving demand for virgin oil.

- By application, the food processing segment captured the largest market share of 38% in 2024. Canola oil is widely used in baking, cooking, frying, and other applications due to its neutral taste and high smoke point.

- By application, the food servicing segment is expected to grow at the fastest rate during the forecast period. Canola oil’s light flavor, versatility, and health benefits make it a popular choice in this sector.

- By distribution channel, supermarkets and hypermarkets held the largest share of 39% in 2024. These retail outlets offer canola oil in various packaging formats to suit different consumer needs.

- By distribution channel, the online segment is expected to experience the fastest growth during the forecast period. E-commerce platforms facilitate canola oil sales through dedicated product listings on websites and mobile apps.

Canola Oil Market Outlook and Insights

Canola oil is extracted from the seeds of the canola plant, which is a kind of rapeseed. This plant was made by using conventional plant breeding procedures to lower the occurrence of erucic acid, which is considered an unwanted compound in large quantities. This oil is low in monounsaturated fats and saturated fats, which are good for heart health.

Furthermore, it is covered with omega-3 fatty acids that have been studied in order to fight inflammation and promote heart health.

It has a big application in cooking as it has a neutral flavor and high smoke point (around 400 degrees Fahrenheit or 204 degrees Fahrenheit as the canola oil is greatly used in baking, frying, and grilling, and as content for salad marinades and dressings.

Major Importers of the Canola Oil Market:

- As per the Canola Oil from October 2023 to September 2024, these imports were being supplied by 19 foreign exporters to the 9 Indian buyers, which marks a development rate of 19 as compared to the leading twelve months. During this time, in September 2024, the globe has officially imported 4 canola oil shipments.

- Worldwide, the top three importers of Canola Oil are the United States, Mexico, and the Philippines. Mexico has topped the world in Canola Oil imports with 609 shipments, followed by the United States with 5,865 shipments, and the Philippines, which takes the third position with 2,588 shipments.

- India has imported many of its Canola Oil from Spain, the United Arab Emirates, and Malaysia.

- The Figure shows the percentage distribution of the global canola oil that is being imported by country in the year 2024. The U.S has dominated the market with 34.3 % of the global imports, which is followed by China with 15.1%, highlighting the importance of demand. Collectively, these two countries show 50% of the global imports in value of canola oil in the year 2024.

Government Support for Canola Oil Market

- In September 2025, the Canadian government, on Sept 5, disclosed the latest measures to assist the country’s biofuels sector and canola farmers, which include the USD370 million manufacturing incentive and the amendments to the Clean Fuel Regulations.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/canola-oil-market

Recent Developments in the Canola Oil Market

- In January 2025, Bayer and Neste, a worldwide company with main competencies in terms of life science fields of the health care and the agriculture, have collaborated with a memorandum of understanding whose goal is to develop a winter canola system in the United States.

- In April 2025. Vegalene, which is a respected name in professional kitchen solutions, has recently announced the launch of its latest 17oz can of the Vegalene Premium 3-oil Blend Aerosol, which is crafted to serve the same exceptional usage and clean release now in an more smooth design for food service operations.

Percentage of Distribution in the Value of Canola Imports by Country in 2024

| Countries | Percentage of Distribution in the Value of Global Canola Imports By Country in 2024 | |

| United States | 34.3 | % |

| China | 15.1 | % |

| Netherlands | 9.8 | % |

| Belgium | 4.5 | % |

| Norway | 4.0 | % |

| Germany | 3.5 | % |

| Mexico | 2.3 | % |

| Sweden | 1.9 | % |

| United Kingdom | 1.8 | % |

| Austria | 1.7 | % |

| Other | 21. 1 | % |

What are Latest Trends in Canola Oil Market?

- Organic and Non-GMO: Users finding the cleaner, more sustainable, and natural options are driving the possibilities for non-genetically modified(non-GMO) and organic canola oil. The organic segment has gained the main market share.

- Health and Wellness: Growing user alertness for heart-healthy dietary choices is a main driver for Canola oil’s lower saturated fat and higher unsaturated fat content, which includes the omega-3 fatty acids, making it a popular alternative to soybean and palm oil, too.

- Minimally processed oils: The urge for minimally processed edible oils has led to a demand for cold-pressed and virgin canola oil. This extraction procedure protects the oil’s natural flavor, nutritional profile, and color that appeals to health-conscious users and the clean-label food industry.

- High-pedic varieties: The food service sector and the food producers are heavily accepting the high-oleic canola oil for its perfect heat stability and extended shelf life, which is perfect for baking and frying.

- Plant-based and tailored diets: Canola Oil is a selected choice for users who follow the plant-based, vegetarian, and Mediterranean diets. Its application in developing vegan and alternative protein products.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5539

Canola Oil Market Dynamics

Driver

Canola Oil Makes Everything Convenient

The canola oil serves as a source of the nutritional advantages, which make it a strong contender for Indian cooking, particularly for those seeking a heart-healthy lifestyle. One of the main points that stands out differently is that it has a high amount of unsaturated fats, specifically oleic acid, which is a monounsaturated fat that the U.S. Food and Drug Administration has chosen for its perfect effect on heart health.

Bakers will also seek the canola oil, particularly, as its mild profile and the fluid texture assist in making soft and moist cakes, rotis, and desserts without including any undesired flavour notes. Apart from this, canola oil constantly serves crispness for fried snacks and a softness, even for the stir-fries and the gravies too. It assists in locking in moisture for baked goods like parathas and cake that include a tender crumb without any greasy nature.

Opportunity

Various type of Canola Oil

The current research is making genetically superior canola hybrids that are higher-yielding, drought-tolerant, and resistant to disease and pests, too. Inventions in refining and extraction, such as megasonic-helped aqueous extraction and the microwave, are pre-diagnosis, which are developing the product quality and smoothness. Also, the acceptance of technologies like the blockchain can assist in managing the canola from farm to table design, which makes sure users are aware of the traditional sourcing and sustainable production procedures.

Challenge

Acids Hinders the Canola Oil Sector

One of the crucial reasons for canola vegetable oil is the presence of erucic acid, a fatty acid found in rapeseed oil. It is usually some repressed classification contained in large quantities of the elements that has since been believed to be toxic when consumed in large quantities. There are health problems linked with high levels of uric acid, including heart disease and toxicity.

Canola Oil Market Regional Analysis

The Asia Pacific dominated the canola oil market in 2024, as this region is witnessing an upward trend, which is being driven by the developing health consciousness, big demand from the food processing sector, and the rising e-commerce too. The region, which is led by India and China, is responsible for the biggest market in 2024 and is expected to continue its current dominance with market development expected through the year 2032.

Also, canola oil has received health advantages, such as its low saturated fat and the high omega-3 fatty acid content, which appeals to the health-conscious users. This oil’s neutral flavor, high heat potential, and stretched shelf life make sit a famous ingredient in packaged and processed food, specifically in the Asia-Pacific region.

What are Latest Trends in Indian Canola Oil Market?

Usually, India is the latest market for canola oil. It is in big demand by the cosmetic sector as it assists in lowering the blemishes, wrinkles, and spots. The development of the cosmetics sector is positioned to drive the growth of the canola oil sector in the coming years. The growing importance of health-linked problems, such as cardiovascular diseases due to high cholesterol, is expected to increase the demand for canola oil in the future years.

For instance, to this,

- In August 2025, Indian has bought the canola oil delivery for the first time in approximately five years, and the local prices have hit a 3-½ year high, which creates an overseas buying opportunity, as the sector officials said to Reuters.

The North America Region is Expected to Be a Notable Region in the Foreseeable Period.

It is being assisted by the constant digital updation across sectors, growing infrastructure investment, and the development of new product inventions. The cloud-dependent and subscription serving are predicted to gain a share, as the hybrid deployment designs will definitely drive the product changes. The short-term urge will be sustained by the pent-up design initiatives and sustainability compulsions, too. The plantation of canola in the United States began in 1988 after being introduced in Canada in 1974. The U.S. canola has an official record of harvested acres in the year 2024 at 2.7 million, up 15% from the year 2023, according to the U.S Department of Agriculture's National Agricultural Statistics Service. It is being harvested in acreage, and the manufacturing in every main canola-manufacturing state is predicted in Montana and Washington.

Trend of Canola Oil in Canada

The bigger domestic usage of Canadian canola was being calculated for the 2024-2025 marketing year, which has the capability of limiting the export volumes. The global canola industry is predicted to find long-term development with elements such as the development of health-conscious users and the urge for plant-based diets, which drives this trend. The industry is also being affected by other companies from domestic biodiesel manufacturers in the United States.

Canola Oil Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Growth Rate from 2025 to 2034 | CAGR of 3.3% |

| Market Size in 2025 | USD 35.72 Million |

| Market Size in 2026 | USD 36.90 Million |

| Market Size by 2034 | USD 47.84 Million |

| Dominated Region | Asia Pacific |

| Fastest Growing Region | North America |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Canola Oil Market Segmental Analysis

Product Analysis

The processed canola oil segment dominated the market in 2024, as linoleic acid is a kind of omega-3 fatty acid, which is frequently named as brain-building fuel, found in the unsaturated fats of cold-pressed canola oil. This fatty acid is more perfect for children and babies as it carries the capability to assist in constructing the pattern of the brain cells during early growth. An accurate and healthy balance of the linoleic acid and the omega-3 helps in regulating the mood and may lower issues like anxiety and depression.

The virgin canola oil segment is expected to rise fastest during the forecast period. Virgin canola oil is manufactured by the mechanical extraction of the seeds at lower temperatures, which generally are below 50 degrees Celsius, without the use of high heat or chemical solvents such as hexane.

This procedure is similar to how extra virgin olive oil is created. The cold-pressing procedure protects more of the naturally occurring antioxidants, such as beta-carotene and vitamin E, and the evergreen factors, which are lost during the high-heat updating for commercial canola oil.

Application Analysis

The food processing segment dominated the market in 2024, as canola oil is utilised in different sectors due to its different characteristics. In industrial uses, it is a main ingredient in biofuels, lubricants, and other environmentally friendly alternatives to petroleum-based products. Basically, it has less viscosity and chemical stability, which makes it perfect for biodiesel manufacturing, which contributes to sustainable energy solutions.

In the culinary industry, canola oil is widely used for its high smoke point, mild flavor, and heart-healthy combination. It is a prevalent selection for frying, baking, sauteing, and salad dressings. It is due to the nutritional profile and the texture, which contains omega-3 fatty acids and the low saturated fat content, as canola oil is a selected choice for the health-conscious users and the food producers.

The food service segment is expected to rise fastest during the forecast period. Canola oil is frequently chosen due to its neutral flavor, balanced fatty acid profile, and low saturated fat content. The vegetable oil, on the other hand, serves as a more reliable and versatile option. It's crucial to note that items which are being labelled as “vegetable oil” are a mixture of various plant oils and have soybean, canola, corn, and sunflower oil that are used in restaurants and cafes.

The temperature at which oil begins to smoke is perfect for the high-hat frying. The oils that have a smoke point, like the peanut and canola oil, are perfect for deep frying.

Distribution Analysis

The supermarket and hypermarket segment dominated the market in 2024, as in this space, canola oil is sold in liquid form in plastic bottles, dispensers, and cans of different sizes, which are frequently found among other prevalent cooking oils. It is a neutral-flavored oil, which is high in unsaturated oils and is available under several famous brands.

The canola oil is most commonly sold in the transparent plastic PET bottles that are shatter-resistant and lightweight. These are accessible in many standard sizes, such as 1 litre, 2 litres, and 5 litres.

The online segment is predicted to rise fastest during the forecast period. The canola oil is being sold on online platforms through an integration of established e-commerce industry, tailored grocery delivery services, and the brand-specific web stores. This strategy aligns with the huge series of users, from those finding ease to those seeking niche products like the cold-pressed oils and the organic ones too.

Also, partnering with the health bloggers and chefs can assist in popularizing canola oil by showcasing its applications and the health advantages.The brands make perfect content, such as recipes and blog posts, in order to educate users on canola oil’s benefits such as its neutral flavor and the low saturated fat.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 271.80 billion by 2034, growing from USD 173.71 billion in 2025, at a CAGR of 5.1% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size increasing from USD 14.25 billion in 2025 and is expected to surpass USD 33.59 billion by 2034, with a projected CAGR of 10% during the forecast period from 2025 to 2034.

- Canned Wines Market: The global canned wines market size is expected to increase from USD 127.88 million in 2025 to USD 332.46 million by 2034, growing at a CAGR of 11.2% throughout the forecast period from 2025 to 2034.

- Plant-Based Protein Market: The global plant-based protein market size is projected to expand from USD 20.33 billion in 2025 and is expected to reach USD 43.07 billion by 2034, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034.

- Bakery Product Market: The global bakery product market size is rising from USD 507.46 billion in 2025 to USD 821.62 billion by 2034. This projected expansion reflects a CAGR of 5.5% during the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

- Pet Food Market: The global pet food market size is expected to increase from USD 113.02 billion in 2025 to USD 167.97 billion by 2034, growing at a CAGR of 4.5% throughout the estimated timeframe from 2025 to 2034.

- Organic Food Market: The global organic food market size is expected to grow from USD 253.96 billion in 2025 to USD 660.25 billion by 2034, with a compound annual growth rate (CAGR) of 11.20% during the forecast period from 2025 to 2034.

Canola Oil Market Top Companies:

- Cargill: A global agribusiness powerhouse, Cargill is one of the largest producers and processors of edible oils, including canola oil. The company operates extensive crushing facilities and is deeply involved in supply chain integration, sustainability initiatives, and bulk B2B canola oil supply for food manufacturers and foodservice operators.

- Bunge Ltd: Bunge is a major player in oilseed processing and international trade, with strong capabilities in canola crushing and refined oil production. Its global logistics network allows it to serve both retail and industrial clients across North America, Europe, and Asia.

- AWL Agri Business Limited: Part of Adani Wilmar, AWL is a prominent name in India’s edible oil market. The company markets canola oil under widely recognized brands and is strengthening its portfolio in premium and cold-pressed segments driven by rising health-conscious consumers in India.

- Marico Limited: Known for its strong presence in the FMCG sector, Marico offers premium edible oils and is expanding into healthier oil formulations. Its consumer-focused positioning and retail reach help drive household-level adoption of canola oil in key Asian markets.

- Archer Daniels Midland Company (ADM): ADM is a global agribusiness leader involved in oilseed crushing, specialty oils, and value-added ingredients. The company’s advancements in refining technologies and high-oleic oil varieties support demand from food manufacturers, bakeries, and biofuel processors.

- Wilmar International: Wilmar is one of Asia’s largest agribusiness groups with integrated operations from plantations to refining. The company produces a broad range of edible oils, including canola oil, and serves both retail and HoReCa markets through strong distribution networks across Asia-Pacific.

- Patanjali Foods: A major Indian FMCG and edible oil manufacturer, Patanjali Foods has been expanding its footprint in healthier and premium oils. Its growing presence in modern retail, e-commerce channels, and consumer wellness positioning supports canola oil’s rise in India.

- CONAGRA Brands Inc.: Conagra produces packaged foods and edible oils for retail and commercial use. Its canola oil offerings support a variety of packaged food products, bakery applications, and foodservice formulations.

- Raj Oil Mills: An established Indian edible oil processor, Raj Oil Mills focuses on producing refined and specialty oils including canola oil. The company benefits from regional distribution strength and a growing interest in premium oils.

- Manishankar Oils Private Limited: A regional player in India, Manishankar Oils specializes in processed and cold-pressed edible oils. The company is increasingly recognized for clean-label offerings targeting health-conscious consumers.

- Gokul Agro Resources: Operating across refining, packaging, and distribution, Gokul Agro offers a wide range of edible oils including canola. Its scale and supply-chain capabilities enable competitive pricing across retail and B2B markets.

- Pansari Industries: A rising name in the Indian edible oil space, Pansari Industries markets canola oil under its consumer brands and is expanding across online and modern trade channels. The company focuses on affordability and accessible packaging formats.

Segments Covered in the Report:

By Product

- Processed Canola Oil

- Virgin Canola Oil

By Application

- Food Processing

- Food Service

- Retail

- Others

By Distribution

- Supermarkets and Hypermarkets

- Franchise Outlet

- Speciality Stores

- Online retailers

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5539

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Beverage Flavors Market: https://www.towardsfnb.com/insights/beverage-flavors-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

➡️Fish Oil Market: https://www.towardsfnb.com/insights/fish-oil-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market